401(k) + Employer Match

- No waiting period – immediately eligible to participate, provided you are a full-time employee

- May contribute according to contribution limits set forward by the IRS

- Limits for 2026 are $24,500, an additional $8,000 if between the ages of 50 – 59 or 64+, and an additional $11,250 for a super catchup if you are between the ages of 60-63

- Effective January 1, 2026, if you are 50 and over, or are turning 50 in 2026, and earned $150,00 or more in 2025, your catch-up or super catch-up contributions, will be designated to Roth 401(k) (after tax), as mandated by the Secure 2.0 Act

- Access to both pre-tax and Roth 401(k) contribution options

- Automatic 5% employee contribution with 1% annual increase*

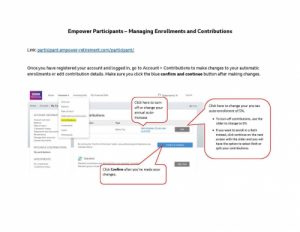

- Ability to change your contribution percentage at any time

- Employer Match is equal to 100% of your contributions up to 5% of your pay

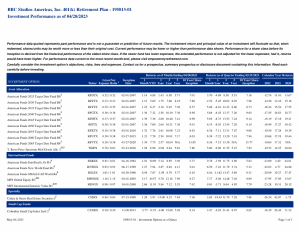

- Diversified menu of investments to choose from

- Designate your beneficiary(s) at time of enrollment or later

- Loans and financial hardship distribution options are available while employed

Employee contributions and the Company Match are 100% vested from day one.

* Unless you select otherwise, you will be automatically enrolled in this Plan with a pre-tax contribution rate of 5% and an automatic increase of 1% annually on every August 1st until a contribution percent of 20% is reached. You will receive a notice from Empower, our 401(k) recordkeeper with details and instructions, and giving you 30 days to opt out or select a different contribution percentage. You can access Empower’s participant website to enroll now and over-ride these defaults, or be auto enrolled as explained.

Important Links and Documents:

Empower’s Tools & Resources:

-

- Who is Empower?

- Empower’s mobile app — download for easy access on the go

- Guide to Change/Stop Contributions

- Market Volatility

- Information on Rolling Over Plans

- Empower Participant Guide

- Empower’s Account Security guarantee

- More information located on the Financial Wellness page