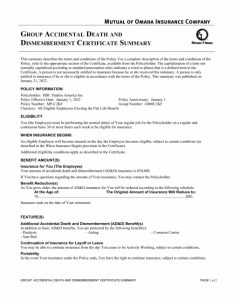

Accidental Death & Dismemberment (AD&D)

Eligible employees are provided with Basic Life and AD&D insurance through Mutual of Omaha, at no cost to you.

Employee coverage can be chosen between two options:

- Flat rate: Flat $50,000 life benefit

OR

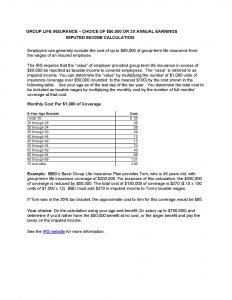

- Earnings-based: 2X annual compensation to a maximum of $750,000 (subject to IRS imputed income, which is taxable to the employee)

Dependent Life Insurance

- Spouse coverage is provided at no cost to employee at the lesser of $2,000 or 50% of employee amount

- Dependent children coverage is provided at no cost to employee with coverage levels based on age.

Video: Life and AD&D Insurance

Common Life Insurance Terms:

Accidental Death Insurance (AD&D): Generally an add-on to a regular life insurance policy, it is only paid if the death of the insured occurs as the result of an accident.

Age Reductions: Most insurance policies reduce your life insurance benefit as you age.

Beneficiary: The person or party named by the owner of a life insurance policy to receive the policy benefit.

Contingent beneficiary: The party designated to receive proceeds of a life insurance policy following the insured’s death if the primary beneficiary predeceased the insured.

Conversion: If you ever leave employment, you may be able to convert the group policy into an individually owned life insurance policy.

Coverage Amount: Value of life insurance

Portable: If you ever leave employment, you may be able to port the life insurance coverage to a lower cost plan.

Premiums: Amount paid to the insurance company to buy a policy and keep it in force.